An update on the CARES Act Economic Impact Payments program:

The Internal Revenue Service and the Treasury Department is delivering a third round of Economic Impact Payments. The initial direct deposit payments have an official payment date of March 17, 2021. Paper checks will start to be mailed soon after.

There is no action required by eligible individuals to receive this third payment.

As with the first and second rounds of payments, most recipients will receive these payments by direct deposit. For Social Security and other beneficiaries who received the first round of payments via Direct Express, they will receive this second payment the same way.

Anyone who received the first or second round of payments earlier this year but doesn’t receive a payment via direct deposit will generally receive a check or, in some instances, a debit card.

Below are commonly-asked questions that may be helpful as you determine if/when you will receive an Economic Impact Payment:

Am I eligible? If so, when will my payment arrive? Please contact the IRS.

-

The IRS Economic Impact Payment Information Center website has detailed information on eligibility, requesting, calculating and receiving payments.

-

The IRS “Get my Payment” website can provide you information about the status of your payment, payment type (direct deposit or paper check) and how to set up a direct deposit if that option is available to you.

Has my payment posted to my account yet? You can check your account from the comfort of your home.

If you expect to receive your payment via direct deposit:

-

Monitor your account and manage your day-to-day banking needs using our digital banking tools (online and/or mobile banking). If you are not currently enrolled in our online banking services, click here.

-

We encourage you to set up a direct deposit account alert to tell you when direct deposits post to your account.

-

The description of the deposit in your account will include the word “IRS.” It is important to note the IRS will use the same description for both the stimulus payment and income tax refund.

-

Download our Mobile Banking app. Our Mobile App allows you to deposit a paper check, using a photo image, and get confirmation immediately.

-

Or, you can deposit your check in one of our deposit-taking ATMs. To find a location near you, click here.

-

You can also make a deposit using our drive-thru services.

-

Visit the IRS website for information regarding eligibility, requesting, calculating and receiving payments.

-

You can check status of your payment, payment type (direct deposit or paper check) and whether or not you are eligible to set up a direct deposit at the IRS “Get my Payment” website.

-

Our associates do not have access to information about your Economic Impact Payment eligibility, timing or distribution as this information is determined exclusively by the IRS.

-

Check the IRS website for information about your payment status and account information.

-

Make sure your contact information is accurate in your account.

-

Remember, if we need to contact you, we will never ask for your personal or financial information through email, text or unsolicited calls. If you receive an email or phone call from someone who appears to be contacting you from our bank and they ask you for any of this information, do not provide it. Fraudsters have the ability to spoof emails and phone numbers.

-

Check out the Federal Trade Commission’s Coronavirus Scam Tips for tips on how to recognize potential scams and learn more about how to keep your information secure.

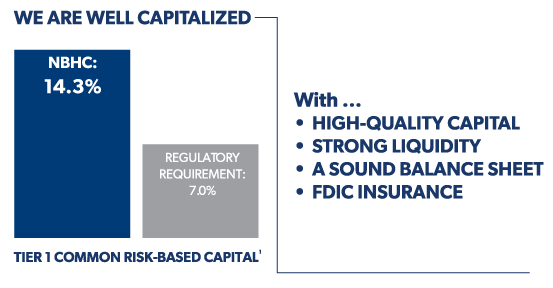

You can rest assured knowing that you are banking with one of the strongest, most well-capitalized banks in the country. Our sound balance sheet, with nearly twice the regulatory-required capital levels and strong liquidity, positions us exceptionally well to withstand volatile market conditions. Please be assured your money is FDIC insured and very safe with us.

You can rest assured knowing that you are banking with one of the strongest, most well-capitalized banks in the country. Our sound balance sheet, with nearly twice the regulatory-required capital levels and strong liquidity, positions us exceptionally well to withstand volatile market conditions. Please be assured your money is FDIC insured and very safe with us.